AI in Financial Services- Key Benefits and Implementation Challenges

Introduction

Think it this way. Your loan company gets hundreds of thousands of applications every day. Is it feasible to check all these applications for your staff, and that too, in a predefined period? Here, AI technology lends a helping hand. Tailored AI solutions for finance can address this requirement effectively.

These solutions offer other benefits including streamlining processes, improving customer support, and identifying fraudulent activities. This blog talks about the scope of AI solutions for finance and key challenges related to their implementation. Let’s understand the role of AI as a game-changer in the fintech sector.

Importance of AI in Fintech Industry

AI can revolutionize data analysis with robust capabilities of processing and and understanding massive amount information in the finance sector. It is useful for increasing productivity and driving digital transformation while improving decision-making process.

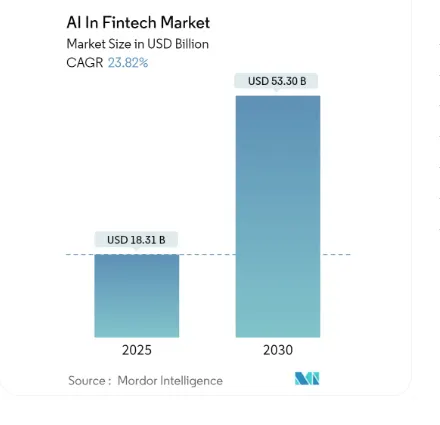

Whether it is data processing or loan underwriting, financial reporting, or fraud detection, AI has a wide scope in the fintech sector. This is a reason an official report has predicted that AI in fintech market would exceed USD 53 billion by the year 2030. These days, AI remains useful in customized and intelligent apps for banking, investments, loans, and payments.

Source - Mordorintelligence

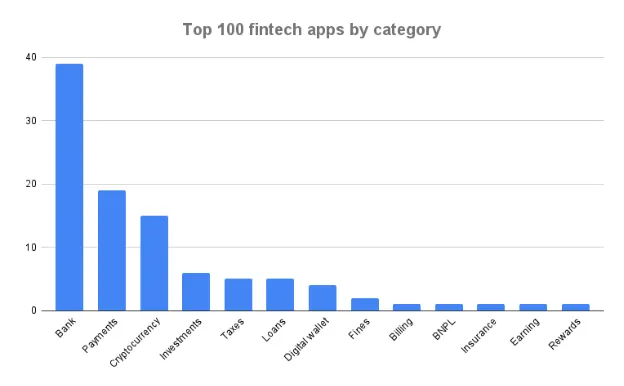

AI development services assist financial institutions to manage large pools of information across all data points. These service providers enable the fintech industry to analyze massive amounts of data for better decision-making and operational efficiency. Talking about the top categories of fintech apps for the year 2025 and beyond, we can mention the following-

Source - Singular

As per this graph, 3 categories have emerged as great beneficiaries of AI development solutions in the fintech sector- banking, payments, and cryptocurrency. Investments, BNPL (Buy Now, Pay Later) and taxes are other categories where the fintech software development can work wonders. Let’s dig in key application of AI in the fintech industry.

Key Applications of AI in Financial Solutions

A reputed financial software development company can integrate AI advancements including language processing, predictive analytics, and cognitive computing. These advanced concepts are useful for the financial sector in many ways including-

Customer Service Chatbots

AI-powered bots can act as virtual customer service executives. They use Conversational AI to offer immediate and personalized support to customers on a 24x7 basis. Moreover, a reputed AI development company can assist financial companies by building robust bots for performing complex tasks including facilitating transactions.

Predictive Analytics Tool

One of the most powerful and interesting AI-based techniques is predictive analytics. It can process vast datasets and predict market trends in advance. Fintech companies can leverage the advantage of this capability to anticipate information on market demands, economic conditions, and user behavior. It is useful for making strategic decisions.

Credit Score Models

AI brings nuances in assessing credit risks. The dynamic nature of AI-driven systems analyze various data points including non-traditional data. It is useful in predicting the applicant’s creditworthiness more effectively. Such enhanced credit score models can expand financial inclusion while increasing accuracy in calculating credit scores.

Fraud Detection Application

How can we skip AI when talking about fraud detection? A reliable financial software development company can integrate AI into fraud detection mechanisms for improving security. It can detect patterns of fraudulent activity and assist financial institutions to mitigate risks proactively. Real-time transaction processing can get the benefit of this application.

User Behavior Tools

Let’s face it. User behavior analytics is not useful for marketing only. Sales, product development, and customer service are other departments that can get the advantage of analysis of the user’s behaviour. Financial institutions or banks can customize their offerings based on the customer’s behaviour and offer them highly personalized approach for increasing satisfaction.

Financial Advisors or Assistants

If you want to offer your customers a useful financial advice in a personalized way, AI can be your trusted option. This technology can analyze customer data including risk tolerance, spending patterns, and financial goals to identify investment patterns. Moreover, AI-powered financial assistants are useful in identifying trends for higher returns.

Here is a quick table of AI applications that can drive digital transformation in the financial sector-

Application of AI | Impact on Fintech Industry |

|---|---|

Customer Service Chatbots | More engagement and 24x7 services |

Predictive Analytics Tool | Strengthened decision-making and more accuracy |

Credit Score Models | Better credit evaluation and financial inclusion |

Fraud Detection Application | Improved prevention of financial loss and control on fraudulent activities |

User Behaviour Tools | Higher insights about the user’s behaviour and personalization |

Financial Advisors/Assistants | Detailed insights for customers for investment and spending |

A reputed AI development company can make various applications for the fintech sector to meet different objectives effectively. Let’s dig in to the top benefits of AI in a thriving yet challenging fintech industry.

Top Benefits of AI in Fintech Sector

Artificial Intelligence is a force to be reckoned with in the financial sector. You may wonder- how can AI be a groundbreaking technology for the fintech sector? Read on to get the answer!

Reduced Operational Costs

AI can automate repetitive and time-consuming tasks including compliance checks. It can save time and efforts while reducing operational costs for fintech companies.

Improved Customer Experience

AI can offer real-time insights to customers in a personalized way for improving their experiences. Whether it is recommending the right loan product or other advice, AI can make the journey more satisfying.

Protection Against Breaches

AI in financial services aims at monitoring for any malicious or fraudulent activities continuously. It can recognize threats early and assist fintech firms to respond quickly.

24x7 Assistance and Personalization

AI-powered chatbots and virtual assistants can give around-the-clock support for handling routine queries. These tools are also useful for personalizing customer interactions for enhancing their loyalty.

Quicker, Accurate Processing

Whether it is loan approvals or risk assessments, AI can accomplish complex tasks at lightning speed without compromising on accuracy. It can also facilitate decision-making meeting compliance requirements.

Here, it is fair to mention that AI solutions for finance offer many benefits to the sector. However, implementation of AI in the sector has some inherent challenges. We cannot gain the AI advantage without addressing these issues.

Key Challenges Associated with AI Implementation in Fintech

While AI offers big business benefits to the financial sector, it is imperative to address some implementation-related challenges including-

Privacy and Data Protection

Fintech companies deal with enormous amounts of sensitive data. This can bring a concern of privacy. It is, therefore, necessary to integrate strong encryption and follow secure data handling practices with access controls.

Compliance with Regulations

This is another crucial challenge related to AI implementation in the fintech sector. Fintech institutions must ensure that customized AI apps align with prevalent regulations and data governance mechanism.

Infrastructure and Scalability

Significant computing power and advanced infrastructure for data processing are key requirements to leverage the AI technology. This needs careful planning and substantial investment.

Technical Expertise with Talent

Implementation of AI needs a multidisciplinary workforce. Experts in ML, data science, and cybersecurity along with AI engineers are essential to include in the team.

Institutions need to consider these challenges during the development of fintech applications. Fintech software development service providers can assist them to address these challenges effectively.

Role of Silicon IT Hub in Addressing Challenges

Silicon IT Hub is a renowned AI software development company. Our in-house team of AI engineers can integrate advancements of AI technology to build a tailored fintech app from the scratch. As a trusted financial software development services provider, we understand the dynamic requirements of the fintech company and research market trends.

At Silicon IT Hub, we strive to address AI implementation challenges by following best practices. Cutting-edge tools and domain expertise with experience of developing tailored AI solutions can assist you to get rid of all challenges. Contact us to learn more about our AI development services for financial companies.

Looking for Developing a Bespoke AI Application for Your Fintech Company?

Concluding Lines

Fintech sector is full of opportunities and challenges. Feature-rich AI solutions for finance can assist respective institutions or firms to grab these opportunities while addressing challenges. From customer services to KYC and credit score assessment to financial advice, AI can play a vital role in taking the fintech to the next level.